Undersecretary Nora Kakilala Terrado: Updates on the State of the Philippine Economy

/Philippine Department of Trade and Industry Undersecretary Nora Kakilala Terrado (Global FWN100™ 2014, Global FWN100™ 2016) delivered her keynote on Updates on the State of the Philippine Economy at the 14th Filipina Leadership Global Summit held in Toronto, Canada on October 27, 2017.

Below is the full text of her keynote speech.

A pleasant morning to everyone.

It is my pleasure to meet you all and present the many positive developments in The Philippines. I am here to encourage those of you who are on the lookout for the best investment opportunities available and assure those who have already invested that our ountry’s growth is permanent and sustainable.

Kindly allow me to reaffirm today that The Philippines is open and ready for more of your business.

The Philippines: The Bright Spot in Asia

In this regard, I wish to emphasize that The Philippines continues to be a prime investment destination not only in the ASEAN region but in the world. This strong investment position is due in large part to the Philippine economy’s continuing robust performance after proving its innate resilience in the face of global uncertainties.

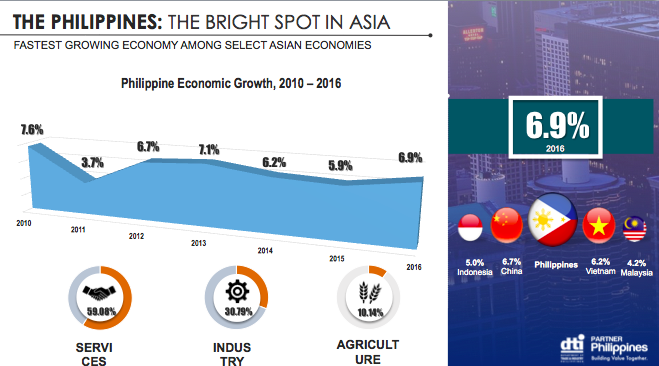

From 2011 to 2016, The Philippines’ gross domestic product (GDP) recorded an average growth rate of 6.1 percent.

In 2016, The Philippines was the fastest-growing economy among selected Asian economies, posting a robust 6.9 percent growth in GDP, surpassing China (6.7%), Vietnam (6.2%) and Indonesia (5.0%) and Malaysia (4.2%).

This is a strong affirmation that our economy is indeed steadily traversing a high growth path, ascending on the solid efforts by both public and private sectors.

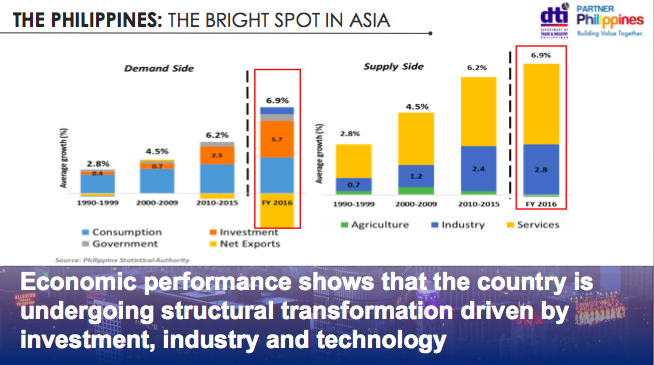

The economy is also undergoing structural transformation. This means that growth is increasingly being driven by investments vis-à-vis consumption, and led by the industry sector relative to the service sector. In other words, sources of economic growth have broadened. Such qualitative change of the economy is crucial to sustaining growth and generating more stable quality jobs.

Total factor productivity (TFP) growth of the economy in recent years has been the fastest in ASEAN, at 2.3 percent. Which also means that capital efficiency (incremental capital output ratio or ICOR) has been improving)

These suggest that economic growth is sustainable, thereby capable of generating more stable and gainful jobs.

The Philippines is one of the world's fastest-growing countries. Real GDP should increase by 6.3% in 2017 after gains of 6.9% in 2016. Robust growth in private final consumption and an increase in public spending on infrastructure (predicted to be 5.8%) are the main drivers. Improvements in investor confidence and rising FDI provide additional support.

The real value of private final consumption rose by 6.5% in 2016 and an increase of 6.4% is expected in 2017. Steady growth in employment and public sector spending provide support

Table 1 details the sources of growth or where growth is coming from.

On the supply or production side, growth in the services sector improved to 7.4 percent, and industry grew 8.4 percent in 2016. However, agricultural growth was a letdown as it reverted to negative territory in the fourth quarter, and for the whole of 2016, reeling from the effects of typhoons “Karen” and “Lawin”. If not for these typhoons, real GDP growth could have hit closer to 7 percent in 2016, as we had hoped.

Domestic demand continued to fuel growth throughout 2016. A robust expansion in investments, growing 25.2 percent in 2016. Public investment in infrastructure remained strong with public construction growing by 28 percent. Private consumption grew 7.0 percent in 2016. All this is attributed to high consumer confidence, modest inflation and interest rates, and improving labor market conditions.

External demand expanded by 10.7 percent in 2016, with merchandise exports rising by 9.2 percent and exports of services maintaining its double-digit growth of 16.2 percent. Growth in imports likewise accelerated by 18.5 percent for the year, reflecting higher purchases of capital and durable goods, which indicate business and consumer confidence, and sustainability of growth.

Growth of the country’s real gross domestic product (GDP) accelerated to 6.5 percent in the second quarter (Q2) of 2017. This is faster than the 6.4 percent growth in the preceding quarter, albeit slower than the 7.1 percent growth in the same period in 2016. Growth in the second quarter of 2017 was in line with the expectations of the market given the 6.5 percent consensus median estimate. This puts the country to be well on track in meeting the lower-end of the full year target range of 6.5 to 7.5 percent GDP growth for 2017.

Gross national income (GNI) growth likewise improved to 6.8 percent in Q2 2017 from 6.2 percent in the previous quarter, albeit still slower than the 7.0 percent in Q2 2016. The acceleration in GNI is supported by the marked increase in net primary income (mainly compensation income) at 8.6 percent. This is faster compared to the 5.4 percent in Q1 2016 and the 6.1 percent recorded in the same period of 2016.

On the supply side, the service sector is still the main driver of growth despite posting a deceleration for the period (+6.1% from +6.7% in Q1 2017 and +8.2% in Q2 2016). Meanwhile, the industry sector recorded marked improvements (+7.3% from +6.3% in Q1 2017 and +7.6% in Q1 2016), supported by the faster expansion in the manufacturing sector, and partly due to the rebound in the mining and quarrying sector. The agriculture sector, which accounts for about 26 percent of total employment, continues to show sustained growth and posted gains (+6.3% from +4.9% in Q1 2017 and -2.0% in Q2 2016) in the second quarter following the increase in production in the cereals and poultry sector.

On the expenditure side, domestic demand slowly gained traction in the second quarter of the year (+6.7% in Q2 2017 from +6.5% in Q1 2017 and +13.0% in Q2 2016), mainly sustained by private consumption and a recovery in government spending. Consumer spending was up slightly to 5.9 percent in Q2 2017 (from +5.8% in Q1 2017 and +7.5% in Q2 2016), supported by record high consumer confidence, modest inflation and interest rates, and improving labor market conditions. Government consumption likewise improved to 7.1 percent, from a measly 0.1 percent growth in Q1 2017 (still lower than the 13.5% recorded a year ago). Meanwhile, investment (+8.7% in Q2 2017 from +10.6% in Q1 2017 and +30.3% in Q2 2016) was tempered by the tepid expansion in durable equipment as well as in private construction.

External demand remained strong, with exports of goods rising to 23.0 percent in Q2 2017 (from 22.8% in Q1 2017 and 8.0% a year ago), while services exports growth decelerated to 9.9 percent (from 12.4% in Q1 2017 and 19.3% a year ago). Likewise, imports growth remained brisk at 20.6 percent, slightly lower than the 22.2 percent relative to Q1 2017 and the 26.3 percent recorded in the same quarter a year ago. Services imports growth bounced to 10.7 percent in Q2 2017, from 4.7 percent in Q1 2017 (though still slower than the 22.0% growth recorded a year ago).

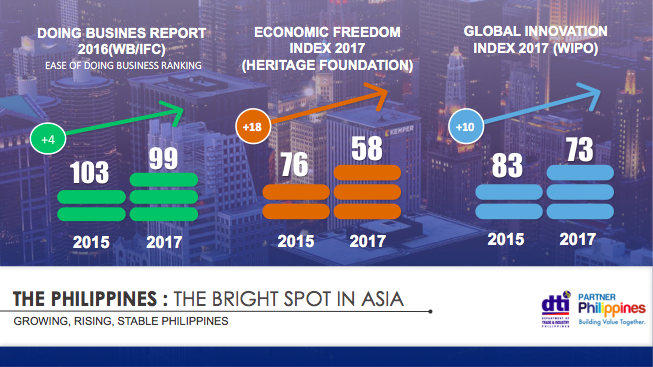

The country’s global competitiveness ranking has continued its marked improvement.

The Philippines climbed four notches in the Doing Business Report from 103rd in 2015 to 99th out of 190 economies in 2016. This was aided by the increased transparency in building regulations. Paying taxes has also been made easier by introducing an online system for filing and paying health contributions, and by allowing for online corporate income tax and VAT returns to be completed offline.

The country has also made it to the top-third of the rankings in the Heritage Foundation’s Economic Freedom Index 2017, up twelve notches to rank 58th out of 180 countries, maintaining its status as a “moderately free” country for four years.

The Philippines also moved up 9 rungs in the Global Innovation Index from 83rd out of 141 economies in 2015 to 74th out of 128 economies in 2016 and up one more to 73rd out of 127 in 2017, as measured by the World Intellectual Property Organization.

The country’s credit rating has continued to improve over the years. As of 2017, the top three rating agencies — Fitch, Moody’s, and Standard & Poor’s — affirmed the country’s “investment grade” rating. The Tokyo-based Japan Credit Rating Agency Ltd. has also affirmed its BBB+ credit rating for the Philippines.

The increasing global competitiveness of the Philippine economy is reflected in the sustained growth in net foreign direct investment (FDI) inflows (FDI) since 2012. The upward trend indicates the growing interest of investors who wish to take advantage of the opportunities presented by the country’s robust economy and stable business environment.

In 2016, FDI reached US$7.9 billion, up by 41 percent over inflows in 2015. Top sectors that gained inflows in 2016 were financial and insurance activities, arts, entertainment and recreation, manufacturing, real estate activities, and construction.

With the sustained improvements in the overall business environment, the Board of Investments (BOI) approved US$9.31 billion worth of projects in 2016, representing a 21 percent increase in investment commitments in 2015.

The top sectors that gained capital commitments in 2016 include Electricity, Gas, Steam & Air Conditioning Supply (47.5%), Real Estate Activities (14.9%), Construction (14.1%), Manufacturing (11.1%), and Transportation and Storage (5.3%). The top sources of foreign capital were Australia (34.1%), Singapore (15.3%), The Netherlands (14.6%), Canada (7.6%), and South Korea (7.2%).

This 2017, some US$3.7 billion worth of projects were approved in the period January-June. The capital commitments were made in Real Estate Activities (42.5%), Construction/PPP Projects (31.7%), Electricity, Gas, Steam & Air Conditioning Supply (13.6%), and Manufacturing (10.1%). The top sources of foreign capital were Singapore (52.2%), USA (11.7%), The Netherlands (10.9%), Denmark (7.9%), and India (5.1%).

Philippine Development Plan (2017-2022): AmBisyon Natin 2040

Under the leadership of President Rodrigo R. Duterte, our country is poised to continue and sustain its remarkable growth and spread prosperity across all sectors with a 10-point Socio-economic Development Agenda:

- Continue and maintain current macroeconomic policies, including fiscal, monetary, and trade policies.

- Institute progressive tax reform and more effective tax collection, indexing taxes to inflation.

- Increase competitiveness and the ease of doing business. This effort will draw upon successful models used to attract business to local cities (e.g., Davao) and pursue the relaxation of the Constitutional restrictions on foreign ownership, except on land ownership, to attract foreign direct investment.

- Accelerate annual infrastructure spending to account for 5 percent of GDP, with Public-Private Partnerships (PPP) playing a key role.

- Promote rural and value chain development toward increasing agricultural and rural enterprise productivity and rural tourism.

- Ensure security of land tenure to encourage investments and address bottlenecks in land management and titling agencies.

- Invest in human capital development, including health and education systems, and match skills and training to meet the demand of businesses and the private sector.

- Promote science, technology, and the creative arts to enhance innovation and creative capacity towards self-sustaining, inclusive development.

- Improve social protection programs, including the government’s Conditional Cash Transfer program, to protect the poor against instability and economic shocks.

- Strengthen implementation of the Responsible Parenthood and Reproductive Health Law to enable especially poor couples to make informed choices on financial and family planning.

In line with the 10-point Socio-economic Agenda, the Philippines’ Department of Trade and Industry with its Board of Investments formulates The Philippines’ Investment Priorities Plan (IPP) that identifies sectors where incentives are offered by the government. The IPP, which has a validity of three years subject to annual review, ensures continuity, consistency, and predictability.

Factors taken into consideration in identifying these priority sectors include job generation in pursuit of inclusive growth as well as opportunities for technology transfer and knowledge/technical skills enrichment. Spatial or geographical requirements as well as industry clustering strategies in attracting investments are also considered.

Under the IPP, there are four priority investment areas: Preferred Activities, Export Activities, Activities with Special Laws, and the Autonomous Region of Muslim Mindanao (ARMM) List.

Under this list, the Top Ten Preferred Activities are:

- Manufacturing

- Agriculture, Fishery, and Forestry

- Strategic Services

- Healthcare Services

- Mass Housing

- Infrastructure and Logistics

- Environment Projects

- Energy

- Innovation Drivers

- Inclusive Business Models

Export Activities cover the manufacture of export products, services exports, and activities in support of exporters.

Activities with Special Laws include areas or activities where inclusion of the IPP and/ or grant of incentives is mandated by law, such as Industrial Tree Plantation (PD 705), Mining (RA 7942), Publication or Printing of Books/Textbooks (RA 8047), Tourism (RA 9593), Refining, Storage, Marketing and Distribution of Petroleum Products (RA 8479), Rehabilitation, Self-Development and Self-Reliance of Persons with Disability (RA 7277), Renewable Energy (RA 9513).

ARMM List include priority investment areas identified by the Regional Board of Investments of the Autonomous Region in Muslim Mindanao. This includes Logistics, BIMP-EAGA (Brunei Darussalam-Indonesia-Malaysia-Philippines East ASEAN Growth Area) related investment enterprises, Tourism, Health and Education Services and Facilities, and Energy.

Opportunities for Investors and Business

Infrastructure Development

In The Philippine Development Plan (PDP) 2017-2022, a key strategy is the development and implementation of infrastructure projects to further the ease of doing business and increase productivity and efficiency by facilitating the smooth flow of people, goods and services.

This offers an abundance of investment opportunities in the development of power and utilities; roads and bridges; water and sanitation; railways, airports and ports; information and communications technology; and security and defense.

Moreover, The Philippines has over 366 economic zones and offers a set of competitive fiscal and non-fiscal incentives to jump start qualified projects from infancy to maturity of business operations.

Fiscal incentives include Income Tax Holiday and Special Tax Rate on Gross Income while non-fiscal incentives include duty-free importation of capital equipment, spare parts and supplies as well as duty-free importation of raw materials and supplies used in export.

While the Income Tax Holiday does not provide exemption from real estate tax, machineries installed and operated in ecozones for manufacturing, processing, or other industrial purposes shall be exempt for the first three years of operation of such machineries. Production equipment not attached to real estate shall be exempt from real property taxes.

A total of 64 big-ticket projects ranging from major road networks, railway systems and bus rapid transit systems to airport and seaport modernization are either for implementation or in the pipeline as part of the Duterte administration’s envisioned “golden age of infrastructure.”

Besides its current projects, the Department of Public Works and Highways (DPWH) is also set to either oversee or implement 10 infra projects in Metro Manila and Mindanao. Among these are: These are the: Bonifacio Global City-Ortigas Center Link Road Project; UP-Miriam-Ateneo Viaduct along C-5/ Katipunan; Metro Manila Priority Bridges Seismic Improvement Project (Guadalupe Bridge and Lambingan Bridge; Widening/Improvement of Gen. Luis St.-Kaybiga-Polo-Novaliches; Cavite-Laguna Expressway; NLEX-SLEX Connector Road; Metro Manila Interchange Construction Project VI; Davao City By-Pass Construction Project (South Section (Road) and Center Section (Tunnel); Panguil Bay Bridge, and Phase 1 of the Metro Manila Flood Management Project.

The Philippines' Strategic Location

The Philippines — strategically located in Asia with a network of international sea lanes and air traffic routes traversing the country — is your ideal gateway to the ASEAN Market. Reachable within 2 to 4 hours by plane and within 24 hours by ship from Asia’s major key cities and travel centers, our country offers one of the fastest, if not the best, access to serve your business interests in the ASEAN market of more than 600 million people, roughly the same size as the European Union today.

The Philippines also provides access to ASEAN’s six free trade agreements with Japan, China, Korea, India, Australia and New Zealand.

Philippines in Demographic Sweet Spot

Apart from our robust economy, strategic location and competitive business environment, the other main attraction for investing in The Philippines is the Filipino people. We have a populatieon of about 100 million with a median age of 23 years. These young people — well educated, highly trainable, hardworking, loyal, and English speaking — comprise our country’s primary asset.

These traits are why there are 10 million Filipinos working outside The Philippines as doctors, nurses, architects, engineers, accountants, teachers, mechanics, seafarers, and all sorts of service staff.

These same traits are also why our Information Technology - Business Process Management (IT-BPM) industry has grown dramatically, from a mere 5,000 workers in 2000 to more than a million to date.

Human Capital Advantage

The competitive advantage afforded by our workforce is highlighted by a recent study conducted by the Japan External Trade Organization (JETRO) where The Philippines was consistently ranked first, ahead of India, Indonesia, Thailand and Vietnam in all categories, including:

- Having Less Linguistic / Communication Problems;

Ease of hiring local staff;

High Quality of Employees, from General Workers to Specialists, Engineers, and Managers;

High Employee Retention Rates

Today, the Philippines is the only Asian country in the top ten of the Global Gender Gap Report of the World Economic Forum. It ranked 7th in the world in 2016 and has consistently been in the top 10 since the first report in 2006.

The report’s Global Gender Gap Index measures the relative disparities between women and men across four key areas: Health, Education, Economy and Politics.

The Philippines has fared well especially in Heatlh and Education, we have been able to ensure that females enter, remain and finish school.

Women’s participation in decision-making and leadership positions has prospered too. More women are getting elected to the Senate and the House of Representatives as well as in Provincial, City and Municipal governments.

As for women’s economic empower, this is supported by appropriate laws and policies which are operationalized in development plans. These include:

RA 7882 “Act Providing Assistance to Women Engaged in Micro and Cottage Business Enterprise”

RA 9501 “Magna Carta for Micro, Small and Medium Enterprises”

RA 10644 “Go Negosyo or Go into Business Act”

Women are key players in the MSME sector. Our data in the Department of Trade and Industry show that 53% of enterprises that registered trade names were own by women, while a study by the Asian Institute of Management (AIM) noted that 63% of managers/owners of businesses they surveyed were women.

Philippines-Canada Trade Relations

At this point, I would like to acknowledge the considerable support that the Canadian International Development Agency has been giving The Philippines in this regard, particularly for the development of cooperatives and micro, small and medium enterprises, the protection of the environment, and the empowerment of women and youth.

We realize, that we will only continue to reap continued economic success with the help of partners. Thus, we are looking to deepen our economic partnership with Canada. Quite frankly, there is a lot of room for improvement in the area of trade and investments.

In 2016, The Philippines was Canada’s 21st trading partner (out of 226), 16th export market (out of 213), and 26th import supplier (out of 207).

Total trade grew continuously over the 5-year period 2011 to 2015 by an average of 6.5 percent with the balance of trade in favor of Canada. However, this slowed down by 8 percent from US$1,027 million in 2015 to to US$945 million in 2016.

Our top export products include: ignition wiring sets (and other wiring sets used in vehicles, aircrafts or ships); electronic conductors (with voltage not exceeding 80v and not fitted with connectors); desiccated coconuts, fresh or dried; syringes, with or without needles; and digital monolithic integrated circuits.

On the other hand, our top import products from Canada are: wood (sawn or chipped, sliced or peeled, of a thickness exceeding 6mm); builders’ joinery and carpentry of wood; wheat and meslin; potassium chloride; and meat of swine, frozen.

Golden Opportunities for Partnerships

In terms of trade, we look to narrowing the gap in our balance of trade by increasing our exports of processed food products (such as fruits, vegetables, marine and ethnic foods), personal care products, furniture, homestyle products, and wearables.

As for investments, the recent pivot of Canada toward Southeast Asia and the ongoing talks to expand economic ties with ASEAN is quite encouraging. We hope that with this Canada will ramp up its investments in The Philippines and make us your primary gateway to ASEAN.

We are particularly interested in securing partnerships in Information Technology – Business Process Outsourcing (IT-BPO) particularly in game development, animation, and Health Information Management System (HIMS).

We also seek more investments and technology transfer in our Manufacturing Sector that has been experiencing a resurgence over the last three years, especially in the areas where you have an acknowledged lead such as aerospace, electronics, food processing, and consumer products.

And, as presented earlier, we are equally keen on forging partnerships for the continuing development of our Infrastructure, which is key to our sustained growth over the long term.

We have high hopes that today will be the start of a new chapter of a deepening economic partnership between our two countries.

Thank you very much and good day.